Press releases – Finance

2012 annual results: a pivotal year

Published 2013-02-19

Operational roll-out of the Be2bill e-money offer

Strengthening of the B to C activities that continue to strongly generate cash flow

Brussels, 19 February 2013, 7:30 AM

Regulated information

Rentabiliweb is today publishing its results for fiscal 2012. The year was marked by the ramp-up of the Be2bill card payment solution, a market in which the group is positioning itself as a major player, and by the simultaneous slowdown of its historical activities, such as advertising and micro-payment.

The Group’s growth relies on two major axes:

- The complementary activities of payment, direct marketing and telecom services within a B to B segment that focuses on the most relevant offers in response to the profitability stakes of e-commerce (traffic acquisition, customer loyalty-building and optimisation of the transformation rates).

- The B to C activities that strongly generate cash flow are providing the Group with additional skilled leverage relative to the issues surrounding e-commerce. This division is made up of several segments: dating, astrology, female well-being and communities.

According to Jean-Baptiste Descroix-Vernier, Chairman of the Group’s Board of Directors :

« Assisting e-retailers is a major issue for actors on the web. Anticipating the changes in the behaviour of web surfers and the stakes for e-retailers over the course of the last 2 years, Rentabiliweb put together a unique offer that combines payment and web marketing. This converging offer is not available from traditional banks, nor from Payment Service Providers (PSP), nor from e-marketing actors. Less than one year after its initial marketing, the Be2bill payment solution is already being used by more than 200 e-retailers. The success encountered since its kick-off is confirming the relevance of the strategic analysis. »

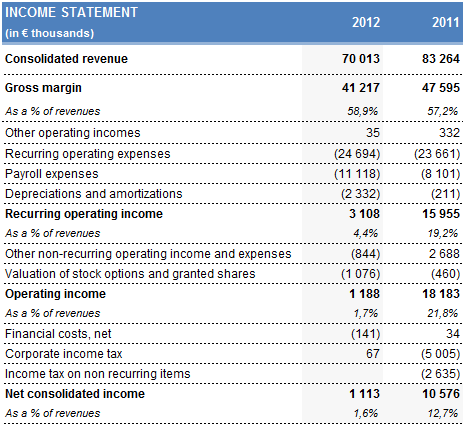

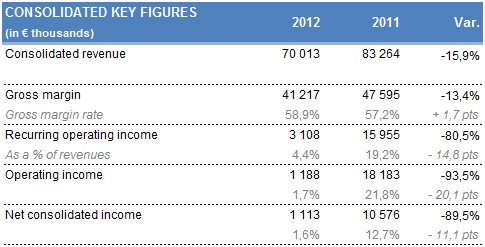

2012 results

- The revenue is equal to €70 million, thereby reflecting the switch between the historic activities and the new growth levers. B to C experienced a difficult economic situation that weighed on household spending and the advertising market. In the B to B segment, the key phenomenon was the restructuring of the micro-payment activity’s client portfolio, and the discontinued marketing of Facebook Credits which, for information, had amounted to €3.5 million in 2011.

- The Gross cash flow rate remains on a high level and continues to improve, to 58.9% versus 57.2% in 2011.

- The company hired new and high potential people, it made major investments and underwent legal reorganisations in order to adapt the company to its new profile. The impact is equal to €3.1 million for the financial year, but promises to produce synergies that will start to bear fruit in 2013.

- The impact on the expenses related to the kick-off and development of Be2bill since April 2012 were equal to €5.7 million for the financial year. For example, the extension of the PCI DSS approval (international transaction safeguarding standards), expected in 2013, was entirely financed in 2012.

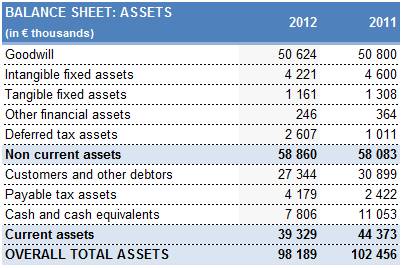

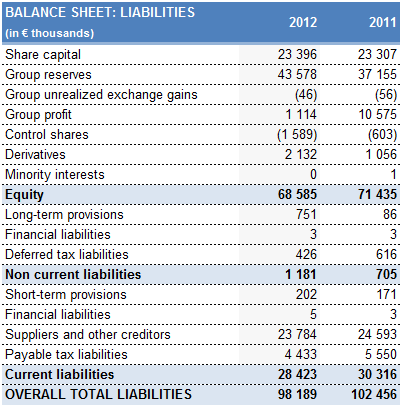

- The Group once again points out its very solid financial situation, with shareholders equity of €68 million, no indebtedness and a net positive cash situation of €7.8 million.

Key figures for the 2012 financial year

Business assessment for the 2012 financial year

B to B segment – Acquisition, retention, monetisation : building on synergies in the service of e-commerce

The B to B activity generated revenue of €26 million in 2012, versus €34.1 million in 2011.

The payment segment, consisting of micro-payment and bank card collections (Be2bill), posted lower revenue notably as a result of the discontinued marketing of Facebook Credits that represented €3.5 million in 2011, and of the restructuring of the micro-payment activity’s client portfolio.

In the second half of the year, the Be2bill collection offer saw very encouraging commercial momentum that resulted in the signing of contracts with major references such as Winamax, Kenzo or pêcheur.com (Oxylane group), as well as a very satisfactory ramp-up: each month, 100% of the clients entrust a growing share of their flows to Be2bill. Be2bill also consolidated its relations with its partners, notably CMS such as Prestashop, Magento, etc. The continuing roll-out of the card payment solution to a broad range of e-retailers and the finalising of the Be2bill structuring should make it possible for this activity to reach financial balance in the final months of 2013.

The business evolution within the direct marketing segment reflects the tighter marketing budgets of advertisers, as well as the Group’s desire to streamline around its most value-generating offers. Eperflex, the solution for retargeting cyber-buyers via e-mail, is establishing itself as a reference in the market, and has already signed exclusive agreements with advertisers such as Zalando, Pixmania, Lastminute, Mistergooddeal and Spartoo. Indeed, Eperflex helps them to generate additional sales while decreasing the number of abandoned shopping carts and failed payments.

The telecom segment continued to take shape around a range of offers that includes the routing of SMS campaigns, the supply of corporate telephone services and call centres, facilities management as well as the processing of surcharged numbers (0800 platform). Contracts were signed with major clients in 2012, and the effects on the revenue will be felt as of 2013.

B to C segment : Constant development of Astrology

The revenue of the B to C segment was equal to €44 million in 2012, versus €49.1 million in 2011.

The lower revenue of the Dating activity, linked to a difficult and competitive context, was brought under control and is now being offset by astrology, that has seen continuous growth since its integration into the Group.

The Astrology activity is benefiting from the market’s off-line to online transition. Combined with the kick-off of new products and the exploitation of new distribution channels such as mobile phones, this transformation is providing the basis for a solid revenue increase in 2012.

Progress of the Gross Margin rate

The Group’s gross cash flow stands at €41.2 million versus €47.6 million in 2012, meaning a gross cash flow rate of 58.9%, which notably translates an increase of 8 points for the B to B segment’s gross cash flow rate thanks to the rationalisation of the micro-payment activity’s client portfolio. The B to C segment maintained a very satisfactory gross cash flow rate (68.1% versus 72.2% in 2011), a testament to the good quality of its long-term relations with its partners.

An evolution of the Operating Profit that reflects the implementation of the growth strategy

The Group’s current operating profit is equal to €3.1 million, versus €15.9 million in 2011.

The B to B activity’s current operating profit was heavily impacted by the negative contribution of Be2bill in the amount of €5.7 million, notably for employment costs, marketing costs and consulting. Within this activity, the Group is now positioned to live up to its high ambitions for conquering market shares.

In the B to C segment, the current operating profit is equal to €11 million. Operating and personnel expenses were brought under control, thereby allowing the marketing investments for the Astrology activity to continue.

The decline of the current operating profit, that stands at €1.2 million, can primarily be explained by the existence of exceptional and non-recurring costs in 2012 (primarily the non-payment of a price supplement and a payment default by one of our customers after the bankruptcy of one of its partners), whereas the Group had recorded, in the 1st half of 2011, exceptional proceeds of €2.5 million (unwinding of a guarantee of liabilities related to a previous acquisition).

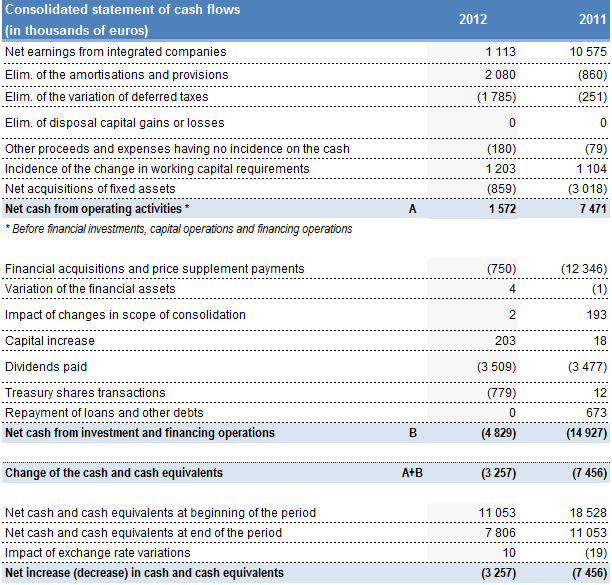

In the end, the consolidated net profit is equal to €1 million at 31 December 2012.

A solid financial situation

For 2012, the available cash flow stands at €1.6 million, while net cash is equal to €7.8 million.

The Group continues to post a solid financial structure with shareholders equity, on 31 December 2012, equal to €68.5 million with no financial indebtedness. The strategy and the efforts made in 2012 now allow the Rentabiliweb Group to expect lasting results. The early indicators for 2013 are providing confirmation of the Group’s strategy choice.

Next communication

Publication of the revenue for the first quarter of 2013: Thursday 18 April 2013.

APPENDICES